Bulgaria has significantly fortified its anti-money laundering (AML) regulations, earning compliance with international standards according to a recent report by a Council of Europe oversight body. The Moneyval follow-up report indicates that Bulgaria has made notable improvements in its measures to combat money laundering and terrorism financing since a critical mutual evaluation report in 2022. This marks a significant achievement for Bulgaria, which had been under strict scrutiny by the Council of Europe’s Moneyval committee.

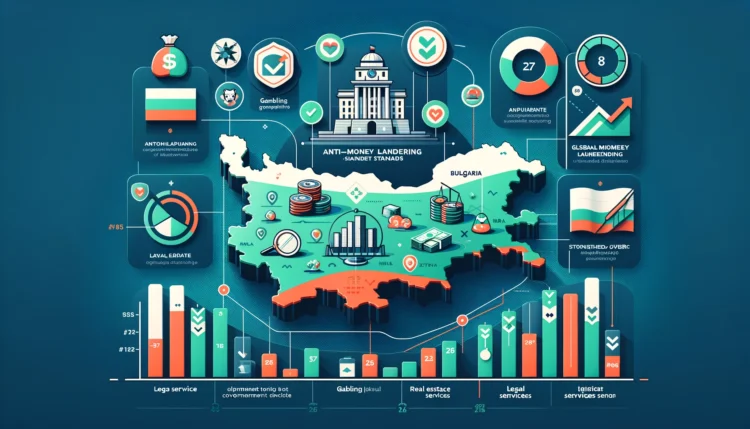

In 2022, the Moneyval committee placed Bulgaria under its compliance enhancing procedures. These procedures involve the Council of Europe working closely with individual countries to address and rectify AML deficiencies. The latest report highlights that out of 40 applicable Financial Action Task Force (FATF) recommendations, Bulgaria is now fully or largely compliant with 13, and at least partially compliant with the remaining 27 recommendations. This progress underscores Bulgaria’s commitment to strengthening its financial systems and aligning with global standards.

Among the areas where Bulgaria has achieved full compliance are the designated non-professional business and professions (DNFBPs) customer due diligence protocols. This includes critical sectors such as gambling and casinos, real estate, and legal services. This improvement is particularly significant given the heightened risks associated with these sectors. “Since the adoption of its mutual evaluation report in May 2022, Bulgaria has taken numerous steps to strengthen its anti-money laundering and combatting terrorist financing systems,” Moneyval stated in their report.

The establishment of a new National Revenue Agency (NRA) in Bulgaria last year has been a pivotal development in the country’s AML framework. The NRA has set up a dedicated AML unit tasked with enforcing stringent requirements such as customer verification, document collection, and conducting risk assessments related to money laundering and terrorist financing. This unit is also responsible for monitoring operations, transactions, and customers flagged as suspicious, and for sharing pertinent information with international authorities. The NRA took over the role of gambling regulation in 2020 following the disbandment of Bulgaria’s State Commission on Gambling.

The creation of this AML unit was driven by Bulgaria’s national money laundering risk assessment, which identified deficiencies across multiple sectors. The enhanced oversight and regulatory measures are part of Bulgaria’s broader strategy to mitigate financial crimes and enhance transparency within its financial systems.

The Bulgarian gambling industry, a significant contributor to the national budget, continues to expand. At the start of this year, it was projected that the gambling sector would generate BGN200 million (£88 million/€102.3 million/$111.7 million) for Bulgaria’s budget in 2024. Over the past two years, gambling has contributed over BGN300 million in taxes and fees. However, obtaining a gambling license has become more costly, with fees increasing by 300%. Additionally, the tax on gambling income has risen from 15% to 20%, reflecting the government’s efforts to bolster its revenue from this thriving sector.

Bulgaria’s enhanced AML measures and strengthened regulatory framework are crucial steps towards ensuring the integrity of its financial systems and maintaining compliance with international standards. These efforts not only bolster Bulgaria’s financial security but also enhance its reputation on the global stage.